Property Taxes Tax Statements & Delinquent Tax Notices

Tax Statements

Paper statements are mailed ONCE per year in mid-August to the homeowner. If you have not received your statement by September 1st, you may call our office at 712-279-6495 option 2. Per Iowa Code Chapter 445 Section 5.5, failure to receive a tax statement does not waive interest or late fees.

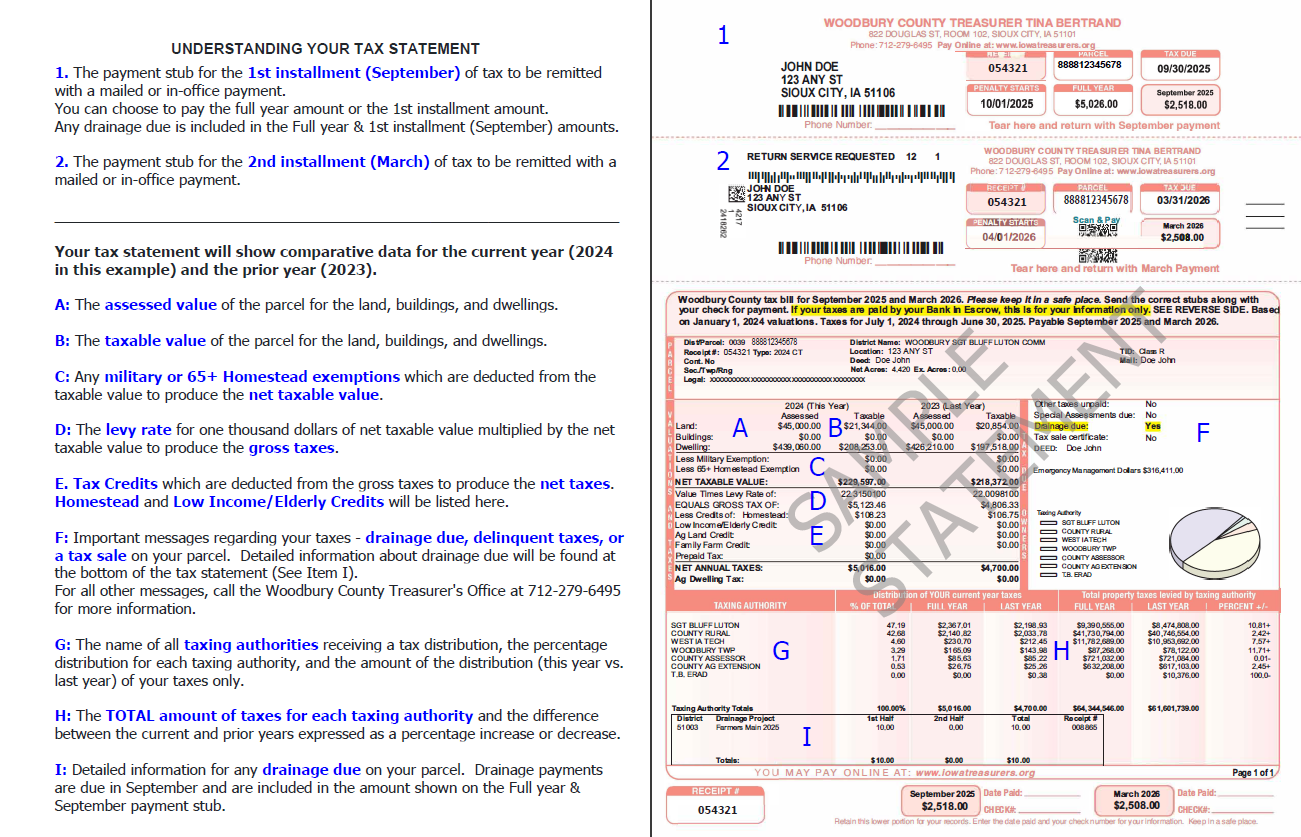

Understanding your Tax Statement

Below is a guide on reading the information included on tax statements. Click on the image to open a PDF version of the guide.

Copies of Tax Statements

You can download a printable PDF of your statement through the Iowa County Treasurers website.

Property tax statements are mailed to the property owner only; NOT to escrow companies. We do not maintain escrow or property management records in most cases. If your taxes are paid by a third party, they are able to obtain your tax information online as noted above.

Notice of Delinquent Taxes

Delinquent taxes accrue interest at the rate of 1.5% per month, rounded to the nearest dollar, with a minimum penalty due of one dollar.

The law requires:

- A notice be sent to property owners who have outstanding taxes as of November 1st and May 1st.

- A notice of the annual tax sale shall be mailed no later than May 1st to the person in whose name the parcel subject to sale is taxed.

- Delinquent taxes as of May 1st are assessed a publication fee and will be published (around June 1st) in a local newspaper before the tax sale in June. To avoid publication, payments must be received in our office by May 21, 2025.

- ALL payments from May 17, 2025 to June 13, 2025 must be made in certified funds. NO on-line payments will be accepted during this time and until the tax sale is processed. (approx June 19, 2025)

- Payments for redemption from tax sales must be paid by certified funds (cash, cashier's check, money order). The rate of interest required by Iowa law to be paid on a redemption is 2% per month. Payments for redemptions cannot be paid on-line.

- If you are redeeming (paying) a tax sale certificate and are not the deedholder of record, an application and affidavit for redemption of real estate sold for taxes will need to be submitted with the payment.

Stay Connected with Our County

Stay Connected with Our County